ESG and “Green” Developments: This now appears to be top of the list with most of the lenders we have spoken to when reviewing development proposals. Although every lender seems to have a different internal policy the end result is the same – if the ESG/”Green” credentials have not been met satisfactorily, the project will either be declined or suffer some sort of penalty e.g. it will attract a penal interest rate (often with incentives to improve ECP’s etc) or a reduction in the loan they will provide. If you have concerns in this area, we can introduce you to a world-leading consultancy group who can advise you on matters of this sort.

Interest Rates: These have risen substantially in the past year or so due to a number of factors including the aftermath of Covid-19 and more recently, inflationary pressures and the conflict in the Ukraine. This means that any real estate development appraisal must be very robust in terms of realistic “costs to complete” and contingencies. You will be very aware that all lenders in this sector are particularly stringent in their analysis of costs in the current climate.

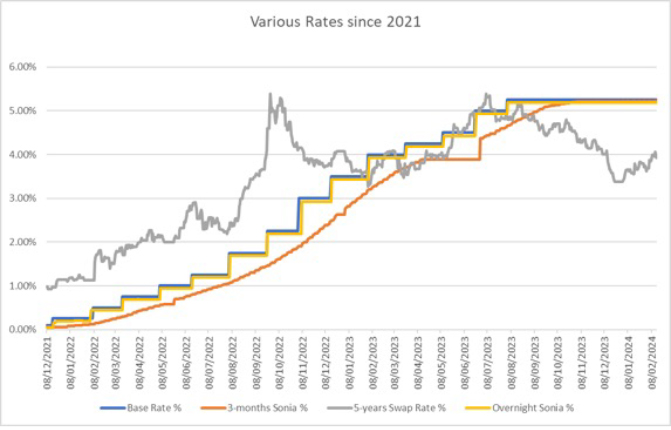

Does this stability herald the beginning of the desired reduction in rates to kick-start

the Real Estate Development sector? At this stage, it’s hard to predict where the next

move will be as the Committee was split three ways in the 31st January 2024 meeting.

The votes were:

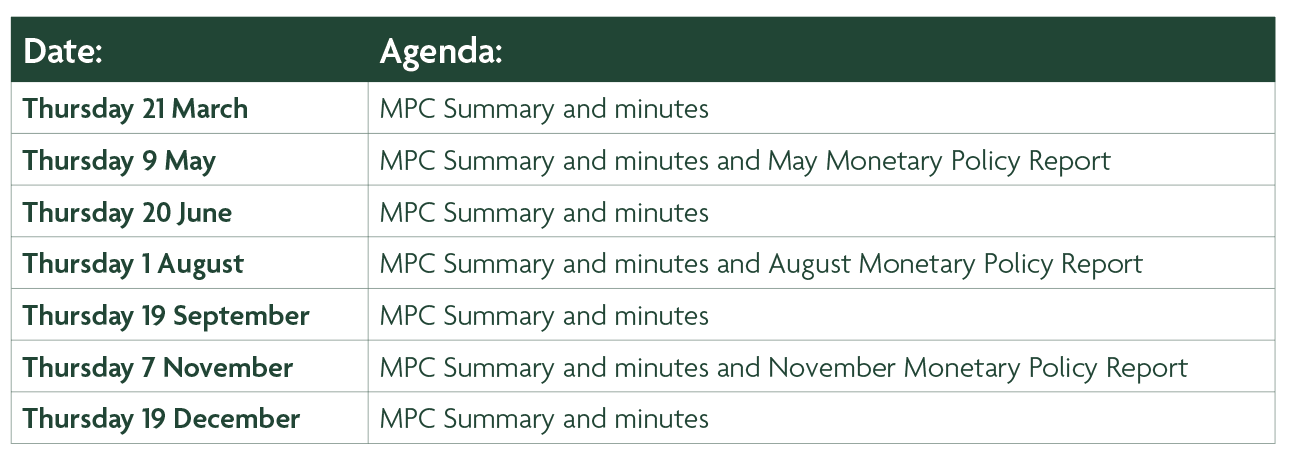

The confirmed MPC meetings for 2024 are as follows:

Watch this space!

The graph above shows the movements in the Bank of England Base Rate against Overnight SONIA, 3-months SONIA and the 5-years Swap Rate over the period from 2021 to date.

As you can see, the 5-years Swap Rate is significantly below the current Base Rate by over 1.2%. Is this the Market pricing in future Base Rate cuts? Only time will tell.

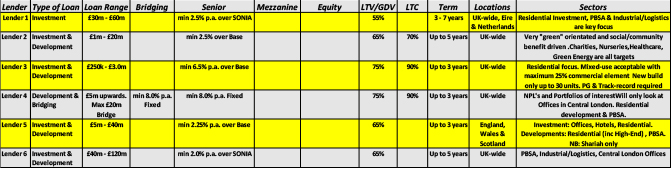

The number and type of Debt, Bridge and Equity providers has been in a state of flux for the past 6 – 9 months with new ventures appearing and established entities disappearing on almost a weekly basis.

However, a number of those that we have met since the beginning of the year have reconfirmed their desire to remain active in the market despite the challenging market dynamics.

They have provided data on their key criteria in the range £200,000 to £100,000,000 and above. Those details are below. As ever, all lenders will look at projects on a deal-by-deal basis, so these terms are indicative only. Final terms will be deal specific and will include security and financial covenants.

Below is a recent article by our MD, Raed Hanna, that was published in the Autumn Edition of The Arab Banker.

If any of the above interests you please contact me or one of my team, full details of which can be found on our website contact page which will also give you an insight into the company’s history and track-record in successfully sourcing real estate solutions for our clients for more than 20 years.

Yours sincerely

Raed Hanna, Managing Director