The New Government and its first Budget: The new Labour Government delivered its first Budget on 30th October 2024 with mixed responses. From a Real Estate perspective what is seen as the main impact?

In essence, all thresholds from First-Time Buyers and Second Homes Stamp Duty trigger points to Discounts on existing social housing purchasers have been reduced or tightened:

All of the above have been imposed to increase tax revenues for the Exchequer but might be seen as disincentives in the housing market.

On the positive side, the current affordable homes budget, which runs until 2026, was boosted by £500m.

How have the “Markets” reacted?

Interest Rates: The Bank of England’s Monetary Policy Committee (“MPC”) sat in the week immediately following the delivery of the Budget.

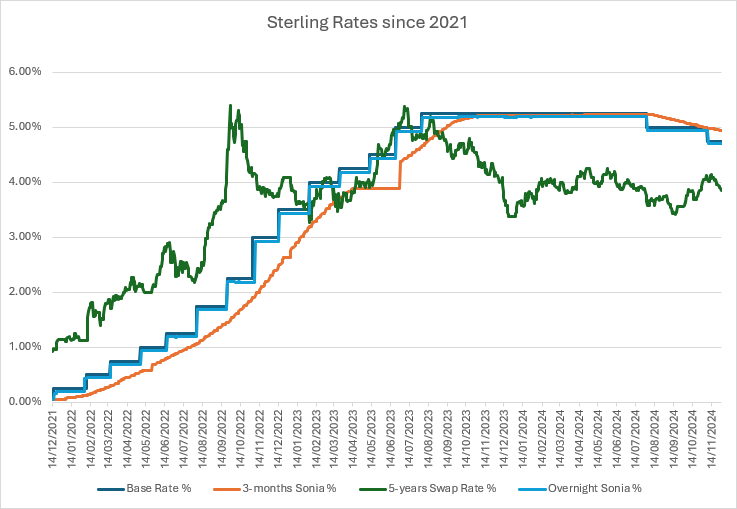

The MPC voted 8 – 1 in favour of reducing the Bank of England Base Rate to 4.75% which was welcomed by most commentators but is it too little, too late? This should have a positive impact on floating-rate facilities as long as Lenders pass this cut on to Borrowers. It might also inject some confidence into the Real Estate market, encouraging Developers and Investors to revisit projects that had previously been shelved. However, the fixed rate markets have been less bullish in their reaction with the 5-years SONIA Swap Rate hovering around 4.0% (up from 3.75% pre-election). This may be as a result of the Government’s proposed spending plans which could result in inflationary pressures surfacing again.

There is little or no expectation of a further rate cut in the last MPC meeting of 2024, on 19th December.

The graph above compares the movements in the Bank of England Base Rate, the daily SONIA Rate, the 3-months compounded SONIA Rate and the 5-years SONIA Swap Rate since 2021. You will see that the spread between the 5-years SONIA Swap Rate and Base Rate has narrowed to only 75bps from 120bps earlier in the year. This may make choosing between the two much more difficult when considering raising finance for a project.

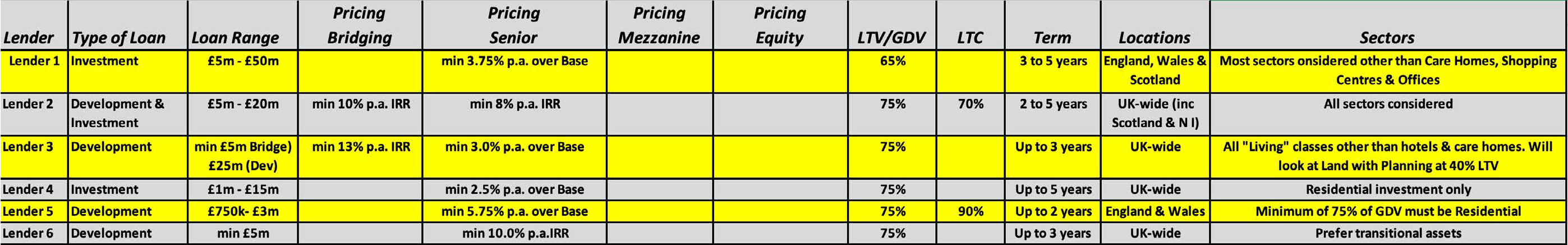

The “merry-go-round” of debt/equity providers did not slow down during 2024 with new entrants out-weighing exits from the market. We have maintained our stance of meeting as many of them as possible to keep abreast of the best terms on offer. Below is a small selection of those that we have met recently who have provided data on their key criteria in the range £750,000 to £100,000,000 and above. Those details are below. As ever, all lenders/equity providers will look at projects on a deal-bydeal basis, so these terms are indicative only. Final terms will be deal specific and will include security and financial covenants.

Below is a recent article by our MD, Raed Hanna, that was published in the Summer 2024 issue of The Arab Banker.

If you wish to know more about any of the above topics, please contact me or any of the team who would be only to pleased to help. Full contact details can be found on our website along with an insight into our history and track-record in successfully finding real estate solutions for our clients for more than 25 years.

Yours sincerely

Raed Hanna, Managing Director