Covid-19 and its variants. We think it is now true to say that Covid is here to stay but that it’s unlikely that we will see the same dramatic and damaging impact from “lockdowns” in the future. The real estate development sector was particularly hard hit with sites being shut down/mothballed due to the enactment of the nationwide restrictions during 2020 and 2021. These inevitably caused completion delays and cost increases. Hopefully, this is all behind us !!

Cost of Materials. These have risen substantially as a result of the issues arising initially due to Covid and more recently, those being caused by the conflict in Ukraine. This means that any real estate development appraisal must be very robust in terms of realistic “costs to complete” and contingencies. You will be very aware that all lenders in this sector are particularly stringent in their analysis of costs in the current climate.

ESG and “Green” Developments. This is now a major issue for all development projects. The main uncertainty surrounding the financing of new schemes is that each lender has its own internal policies that it must adhere to when approving a facility. MFL is ideally placed to help you with selecting the right source of funds for your project as we maintain regular contact with the lenders in this sector. We can also introduce you to a world-renowned consultancy group, should you need expert advice on dealing with ESG matters across new build projects or standing investments.

Interest Rates – how high? The Bank of England Base Rate currently stands at 1.25%, having risen 1.15% in the period since 6th December 2021. The 5-year’s Swap Rate is now 2.67%, having risen from 0.97% on the same date. What does this bode for the future? It seems that the financial markets are anticipating further Base Rate rises in the coming months. Is it now time for developers and investors in real estate to consider hedging products?

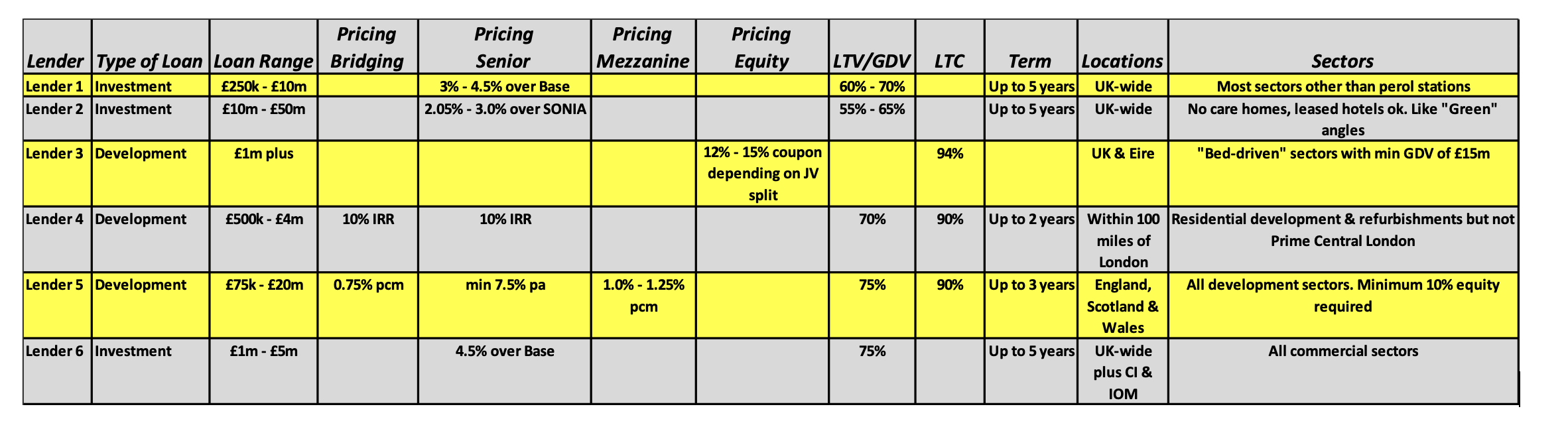

There has been a significant increase in the number and type of debt/equity providers in the past 12 months. The loans on offer have covered the range from £50,000 to £150,000,000 and above. A selection of those lenders is below, along with their headline terms. NB All lenders will look at proposals on a case-by-case basis so these terms are indicative only. Security requirements and covenants will be deal specific.

How to determine the value of an Hotel in 60 seconds!

Click on the link below if you will find this useful.

During 2021, and despite the impact of Covid, MFL closed £912m of facilities across a myriad of deals. These included new developments, major refinancing’s and bridging loans.

The following are a selection of those deals:

If any of the above interests you please contact me or one of my team, full details of which can be found on our website contact page which will also give you an insight into the company’s history and track-record in successfully sourcing real estate solutions for our clients for more than 20 years.

Yours sincerely

Raed Hanna, Managing Director